Table of Contents

- Solution 1

- Solution -2

- Solution – 3

- Solution -4

- Reference

Solution 1

Issues

The fundamental aspect of the give cases, are to identify the nature of the expense or loss and to elaborate with the eligibility for under section 8-1 of income tax Assessment Act 1997. In context to identify the eligibility for expense or loss, that such expense or losses are eligible for deduction or not.

Legal aspect under ITAA

In accordance to section 8 -1 of the ITAA, an expense which are revenue in nature can be claim as deduction only, that mean any the capital expense cannot be claimed under section 8-1 of the said Act. It was found in one of the case where the federal court has held that the any expenditure incurred for the alternation or development of exiting felicities (development of expansion of business) than such expense are capital in nature and are not eligible under the said section,

Where the nature of expense has a connection with the income generating capacity of corporation, such expense are eligible for deduction under section 8 of the Act. In one of the case the judicial authority had decided that the any expense which not result in to productive income for tax payer than such expense can not be claim as allowable expense under section,

Section 40-880 of ITAA states that any legal cost relating to winding up of company are eligible to the extent of 1/5 of total expenses. (Ato.gov.au. (2017).)

Application of above legal aspect in each individual conditions

- Cost of moving machinery for a new site: Here the cost incurred for the moving of machinery to other place are capital in nature hence not eligible for deduction (Ato.gov.au. (2017).)

- Cost of revaluing the assets to effect the insurance cover: In current case the revaluation of assets has a no connection with income so not eligible expense

- Legal expense incurred by the company opposing a petition for winding up: In given situation it is seem that the legal expense are capital in nature and the condition as discussed above the capital expenses are not eligible under section 8. However the

- Legal expenses incurred for the service of a solicitor: Here, the legal advice in connection with the discharge of a mortgage and of conveyancing are capital in nature so not deductible but the general legal advice relating to a client’s business operations, are revenue in nature so eligible for deduction.

Conclusion

For from the above discussion, all the give expense are not eligible for deduction such as the moving of machinery, and the legal advice of solicitor for mortgage and conveyancing, while other two expense are eligible for deduction under section 8-1 Of ITAA.

Solution -2

Issue

Here, the main point for discussion are the identify the eligibility and extent of availability of input tax credit to the Big Bank for the advertisement expense incurred by it under the GST rules

Legal aspect and rules of GST.

Following are the condition need to be satisfy In order to claim GST credit

- The taxpayer must be register with the tax authority for GST

- The good or service so purchase or used are related to business

- The price of the good or service so paid were including the GST amounts

- The buyer of goods or service shall hold a tax invoice

On satisfactory compliance of above condition make the tax payer eligible for input tax credit. (Apps, P. and Rees, R. (2013).

Further the credit shall be available as lower of 10% of the total entitlement of the total input tax credits or $ 150,000. Moreover, any Acquisitions that tend to involve input taxed supplies in the context or loans or deposit facilities fail to be recognized as creditable acquisition. On the other hand, acquisitions that tend to lead to taxable supplies i.e. involving home and content insurance are recognized in the form of creditable acquisition

Application of Rules in current case

Considering the above facts and the situation of current case, the insurance related advertisement expense are eligible and hence the tax paid on same will be eligible for credit, here the advertisement expense related to insurance consisting of input tax credit of $ 50000, which is eligible for deduction.

Further, the limit under FAT, was cross by the bank, hence for general advertisement expense, it would be advisable to forward the appropriate portion on reasonable manner.

Conclusion

Here, as part appropriate portion we can assume that 1 % deduction for the insurance expenses, that mean for such portion we would like to go with general taxation, and reaming 99 % would be expense for business

That means, 1 % of $ 100000 would be available for input tax credit and reduced input tax credit relating to advertisement would be Zero.

Solution – 3:

Issue

Here, our main cornered is to determine the foreign tax offset for Angelo

Rules

In accordance to the provision and rule of Australian taxation Law, it was clearly mention that the individual tax payer will be liable to pay tax on his/her international income ones in a time, that means tax paid on the overseas country in context to the income. It will not be tax twice again in to the Australia, these rule are specifically introduce with the intention to avoid a situation of double taxation. So where the taxpays files it tax return with the authority he/she should make a claim for tax paid into the oversea countries.

Condition for claiming the foreign tax set off.

- The taxpayer had already paid tax on the foreign income to the overseas authority

- The tax on other income are computed as per the Australia tax law

The foreign tax setoff, setoff are determined as per the foreign tax setoff limit, the limit is the maximum permissible limit the taxpayer can not claim the deduction in excess of threshold limit.

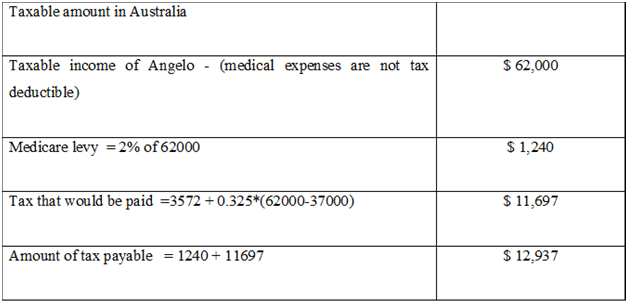

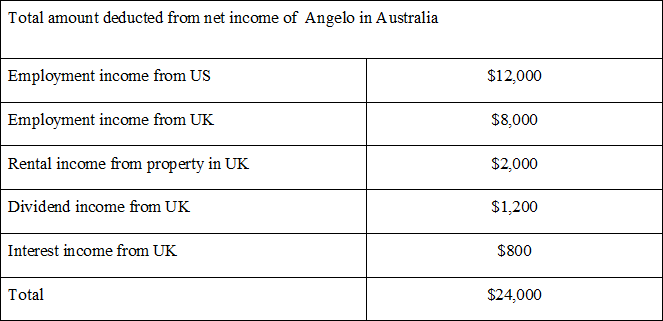

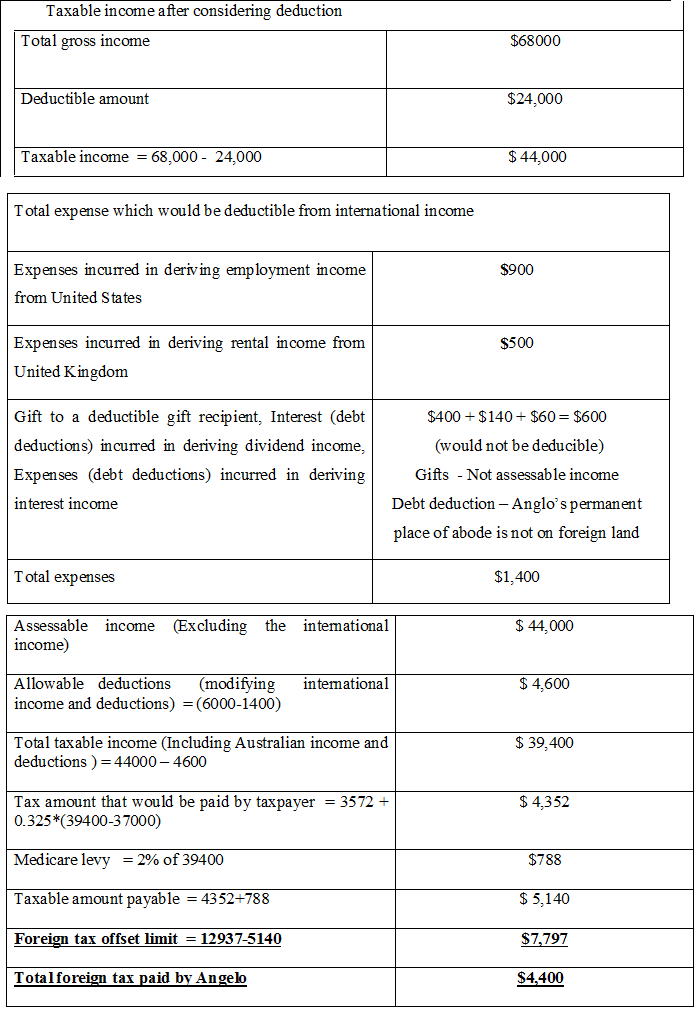

Computation of foreign tax offset of Angelo

Conclusion

Conclusion

After analysis the applicable rule, and applying the same in computation of taxable income and foreign tax setoff limit, it was observed that total foreign tax paid by Angelo would be $ 4400 while the foreign tax setoff limits is $ 7797. Total tax paid by the Angelo are lees that the foreign tax limit. That mean the foreign tax setoff available for Angelo would be $ 4400.

Solution -4

Scope

The objective of the problem are to compute the net income of Johnny and Leon’s partnership firm.

Rules

The fundamental principles for computation of incomes state that the net comes refers to the difference between the total of taxable income and deductible expenses. So her, while computing the total taxable incomes and deductible expense we shall check the applicable rules based on the each of the transactions.

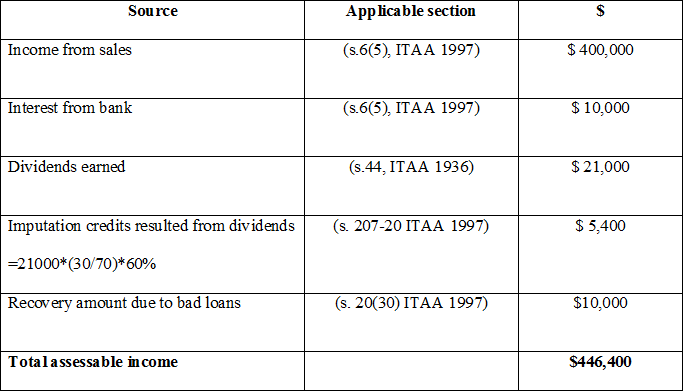

Application of rules

The exempted income will not the a part of assessable income this is because of the fact that if any long term gain if realized to partnership firm than such gain are distributed among the partners in equal proportion.

Note for the above computation

- The interest income and salary would not be eligible for deduction of tax

- The Bad debt would not be amount to tax deductibles in accordance to section 25( 35), ITAA 1997

- The loss was already distributed among the partners in last financial year

- The capital expense are not eligible for deduction under section 8-1 of the ITAA 1997

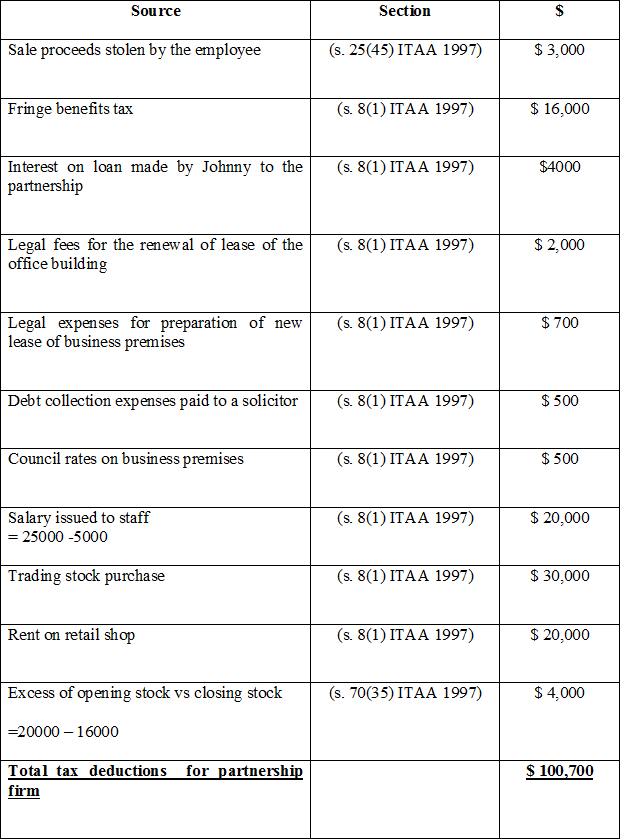

Eligible deduction

As discussed above, the net income would be difference between the eligible income and allowable expenses

So income would be $ 444,400 less eligible deduction would be $ 100, 700

Net income equal to $ 345, 700

Reference

-

Ato.gov.au. (2017). Other operating expenses. Available at:

https://www.ato.gov.au/Business/Income-and-deductions-for-business/Deductions/Other-operating-expenses/ [Accessed 23 sep.2017].

-

Ato.gov.au. (2017). Legal Database. Available at:

https://www.ato.gov.au/law/view/document?DocID=TXR/TR9524/NAT/ATO/00001&PiT=99991231235958 [Accessed 23 Sep. 2017].

-

Apps, P. and Rees, R. (2013). Raise Top Tax Rates, Not the GST. SSRN Electronic Journal.

-

Pearl, D. (2016). The Policy and Politics of Reform of the Australian Goods and Services Tax. Asia & the Pacific Policy Studies, 3(3), pp.405-411.