Introduction

The global financial crisis of the year 2008 was started in United States of America a scrawled its way throughout the world as world economies today stand to be highly globalised and all the countries depend on one another for their economic sustainability. The article below discusses the possible causes of the global financial crisis of 2008 and tries to answer the questions like whether global financial crisis could be repeated again. The discussion below ranges from the effects of financial crisis in today’s world and the loopholes in the international economy that could result in the repetition of the global financial crisis. The discussion finally ends in certain proposals as to how the financial crisis be mitigated.

Causes of global financial crisis (Davis, 2014)

The crisis popularly known as the global financial crisis began in the month of July in year 2007. The lack of faith in the mortgage properties of the United States investors started the panic attack which ultimately resulted in liquidity crunch leading to a crisis like situation. The investors rapidly began to withdraw money from the financial instruments further making a panicking situation even worse. The stock market crashed after this situation further worsening the situation even at the global level. This was further augmented by the burst of the house bubble.

House bubble, also known as the subprime crisis was the crisis which was created when the owners of the houses who had mortgaged the homes to take loans found out that they were not able to pay the mortgage amount. The banks then found out that the homes which they had taken as security were valued far less than the loan they had originally handed out to the takers. This essentially resulted in liquidity crunch for the banks putting the fear of banks shutting down. This resulted in closure of the largest American Bank the Lehman Brothers.

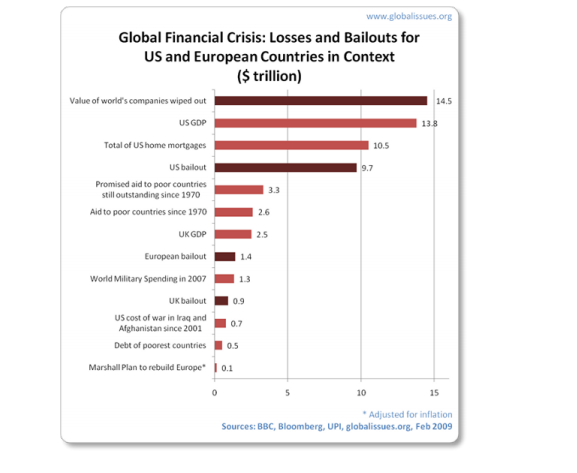

Below is the diagrammatical presentation of the global financial crisis and the losses incurred during it (Shah, 2013)-

Looking closely at the reasons of global financial crisis, it could be said that the bursting of the house bubble was the reason for the triggering of the global financial crisis.

If we look further as to why the financial crisis occurs at any point of time, there are certain common factors (Capital institute, (n.d.)). Some of them are listed below-

- Leverage- excess leverage whether to the investors or the lenders always causes trouble. The accounting for the leverage is not possible and when such leverage goes beyond the control of balance sheets, the crisis starts.

- Liquidity – the second reason is also like the first one. If the banks are lending the long term loans then the borrowings against such lending must be covered by the long term borrowings only. Problem starts when the borrowings become short term and are lend to the party on the long term basis. This creates a liquidity crunch situation for the banks.

- Too big to fail- the industries have now become so large and so important for the sustainability of the economic welfare they needs to be managed very meticulously. For example, the banks must be operated at the decentralized level because the banks deal in trillions in volume data and the failing of one aspect of the bank must not bring down the cumulative effect of the crisis to all the entities. Decentralization will cause the banks to operate at a more independent level providing sufficient room for separate operations.

- Conflict of interests – the banks in the process of satisfying the interests related parties may lead to creating a situation where they cater to only limited clients leading to a concentrated customer base relating to one industry which in turn will lead to collapse of the bank if the industry to which its customers relates also collapses.

- Taxes and subsidies- the taxes and subsidies are important as they are responsible for the fund movement in the economy and if there is a crunch like situation then a bailout package must be given by the government to secure the economy. However, the taxes if possible must be relieved at the time of crisis so that the general population does not suffer much during that period of crunch.

- Governance- the governance of the country largely ensures that the economic conditions are clear and prevents the crisis. If this becomes loose, then the conditions may become out of control certain times.

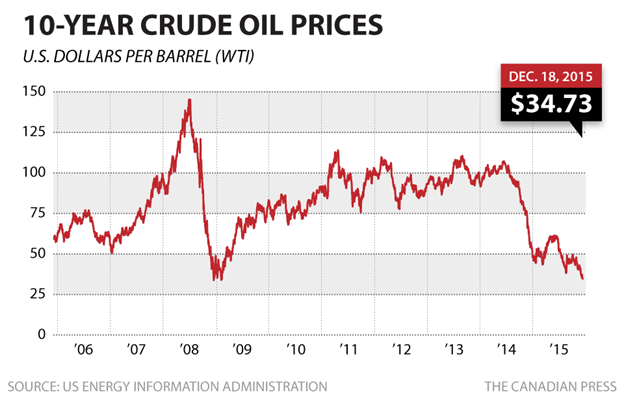

Global financial crisis according to some reports could happen again. The logic behind this assumption is indeed quite simple. The global economy is developing and improving at a pace faster than the USA’s economy. The economies are linked to each other and the global economic development shall lead to a recession like situation again. The deflation in United States of America is again coming and as claimed in some reports, the condition of the US economy is in far worse shape. The global economic crisis is further strengthened by the fact that the crude oil prices in the beginning of the year is $30 barrel which is too low (The guardian, 2016) The USA’s economy is hit by this recent development. The diagram below gives a better idea of the crude oil situation for the past 10 years.

The reforms by the USA’s government and the global economic changes have controlled the situation to a certain extent but as the size of the economies go larger and larger; the fear of bigger damages and bigger failures also arises.

Impact of financial crisis on different countries

The global financial crisis shook the entire world and took the smaller economies by storm (Bruno Gurtner, 2010). The developing countries especially were the victims of the financial crisis and originator of such crisis was the shaking economy of developed countries among which the main creator was the USA’s economy which trembled after the bursting of the house bubble. The developing countries were the major victims of the global financial crisis.

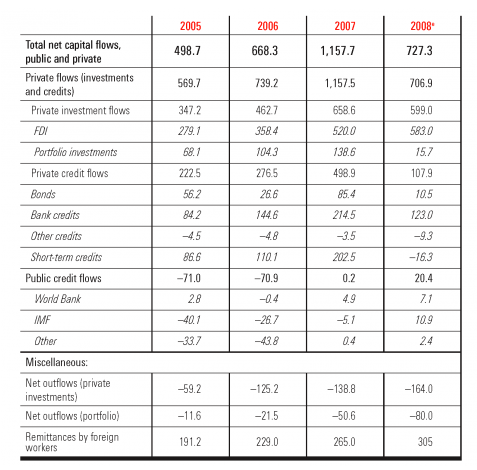

The chart below shows the capital flows to the developing countries from the year 2005-08 ( in United States Dollars):

Source: World Bank Global Development Finance (2009), table 2.1, p. 40. Abbreviation used in the table: e: estimate.

The developing countries faced the capital outflow during the major part of year 2008 and 2009 where several countries like Argentina faced capital outflow to the tune of USD 20 Billion, Mexico faced outflow to the tune of USD 19 billion. Similarly, the remittances by the migrants from the developed nations to the developing nations virtually vanished for a good number of years further bringing down the capital induction in these countries. Some of these countries even faced the backlash from the developed nations where the foreign workers were repatriated to the home countries thus burdening the already sunk economies of these countries. The countries from the Asian side also faced other challenges. For example, the total exports from Bangladesh dipped to an alarming rate. The tourism income in the African countries crashed greatly. The income from copper in the countries like Zambia crashed to a staggering 54%.

There were several studies which should that the economies affected by the global financial crisis were affected on a different scale. Some economies were directly affected like that of Europe and United States of America, some were indirectly affected like China and India while some were mildly affected.

The Nepalese economy is one which was mildly affected by this crisis (Khadka and Budhathoki, 2013). There was no sharp dip in the gross domestic product, there was no insolvency reported in financial institutions. This was on one hand. On the other hand, the income of the local people dipped as the income of the company dipped. This was because the major source of earning for the local people is tourism which sharply fell because of the dip in the foreign tourists. The rate of remittances in Nepal after the global financial crisis of 2008 has subsided. The export of Nepal made clothes has also been hit. Also, Nepal is one of the least developing countries in the world. The foreign help shrunk to very small amounts after the global financial crisis of 2008. Foreign Direct investment decreased to very marginal levels during the crisis but it has increased significantly during the last several years.

Proposed reforms on the world scale after the global financial crisis may be studied as under:

There were regulatory reforms at the international level and at the national levels of all the countries. Some of them could be analyzed as under

- G20 action list-

- Strengthening of bank capital and understanding the liquidity requirements of the banks was a major concern area which was dealt deftly.

- The accounting standards both at the national and international level were proposed as one of the main changes for contributing to curbing the circumstances of the next global financial crisis.

- The regulatory framework was analyzed and proposed changes implemented to make sure that another crisis does not hit the economic environment.

- Banking reforms at the national and international level (Business, 2013)-

- The European nations have made a lot of changes in the remuneration and the bonuses of the banking staff. The high remunerations and the bonuses have been restricted by the national laws now. This is done after the view was taken that the bonuses that too so high could not be given after such a huge failure of the banking system.

- The banks in the countries of Europe were levied a special tax called levy for the limited periods in order to raise 8 billion pounds. The logic behind such a move of implementing tax was that the global financial crisis started after the failure of the banking system and it was only just that the banking industry should now contribute to the development and recovery of the economy from the damage caused by the economic crisis.

- Various studies are being conducted to separate the retail banking structure from the riskier investments made by the banks. This is done with the view that the mistakes of the bank should not be paid by the general public. As was evident from the house bubble burst, the banks for the sake of earning profits may put the hard earned money of the general public into very risk real estate investment which could jeopardize the savings of the common man and could at the macro level trigger the avalanche of global slowdown.

- The executives who are being considered for the top positions in the banks are interviewed at the initial stages especially in United Kingdom to protect the money of the investors and depositors of the bank. This was done because it was assessed that had the executives been grilled earlier, then this global financial crisis could have avoided to a certain extent.

- Regulatory changes have started to occur after the economic slowdown.

Conclusion

The global financial crisis of year 2008 brought a lot of damage to the economic condition of the world. The fall of the Lehman brothers was the eye opener for the entire world. This was because the invincible was defeated within a matter of 10 months. USA’s largest bank had collapsed. The house bubble burst and the subsequent panic had led to the government with infusing the economy with a bailout package of $ 1 trillion. The developing nations were hard hit. However, as the other economists predict, this was just a trailer of the large damages coming ahead unless the governments make huge changes in the fundamental economies of their country which could only averse the further financial crisis of the world. The crisis hit the economy of countries in Asia and Africa most because these countries directly depend on the economies of European nations for their income. The foreign remittances and the exports from major part of their income. Most of the African nations are solely depended on the tourism industry which came to a halt during the financial crisis. The reforms have taken place as given above and are still going on to make oneself immune to vulnerabilities of the weak economic system.

References

Anup Shah, 2013. Global Financial Crisis. [Online] Available at http://www.globalissues.org/article/768/global-financial-crisis [Accessed Date 7th May, 2016]

Justin Davis, 2014. Global Financial Crisis – What Caused it And How the World Responded. [Online] Available at http://www.canstar.com.au/home-loans/global-financial-crisis/ [Accessed Date 7th May, 2016]

Capital institute, (n.d.). The Six Root Causes of the Financial Crisis. [Online] Available at http://capitalinstitute.org/blog/six-root-causes-financial-crisis/ [Accessed date 7th May, 2016]

The guardian, 2016. Beware the Great 2016 Financial Crisis, Warns Leading City Pessimist [Online]. Available at https://www.theguardian.com/business/2016/jan/12/beware-great-2016-financial-crisis-warns-city-pessimist [Accessed Date 7th May, 2016]

Bruno Gurtner, 2010. The Financial and Economic Crisis and Developing Countries. [Online] Available at https://poldev.revues.org/144 [Accessed Date 7th May, 2016]

Khadka, M., Budhathoki, N., 2013. Global Financial Crisis and Nepalese Economy [Online] Available at http://www.gdn.int/admin/uploads/editor/files/2013Conf_Papers/ManbarSKhadka_Paper.pdf [Accessed Date 7th May, 2016]

Business, 2013. Banking reform: What Has Changed Since the Crisis? [Online] Available at http://www.bbc.com/news/business-20811289 [Accessed Date 7th May, 2016]